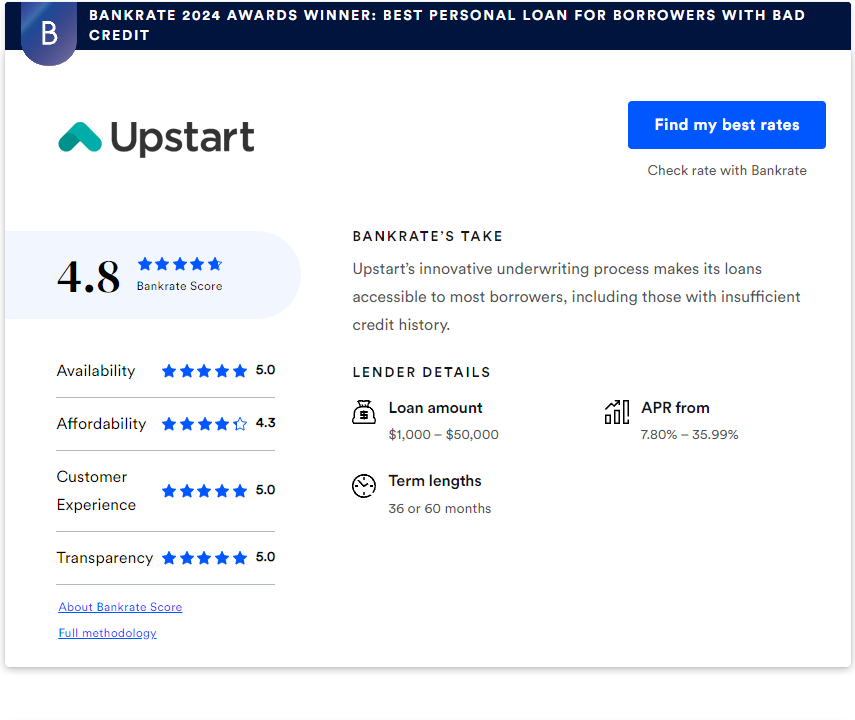

At a look

Upstart is greatest for very bad credit debtors and people with restricted credit score historical past

Although Upstart’s APR cap is on the upper facet, the lender has one of the vital aggressive beginning APRs at 7.80 %. Debtors can verify their charge with out hurting their credit score in just some minutes and mortgage quantities begin decrease than most private mortgage lenders and go as much as the everyday most.

Upstart makes choices primarily based on extra than simply the borrower’s credit score rating — academic and profession background are additionally a part of the equation. This modern strategy and lack of credit score rating requirement make it a lovely choice for debtors who might not qualify with a standard lender. The truth is, Upstart Bankrate’s choose for one of the best private mortgage for very bad credit debtors in 2024.

Upstart private mortgage functions

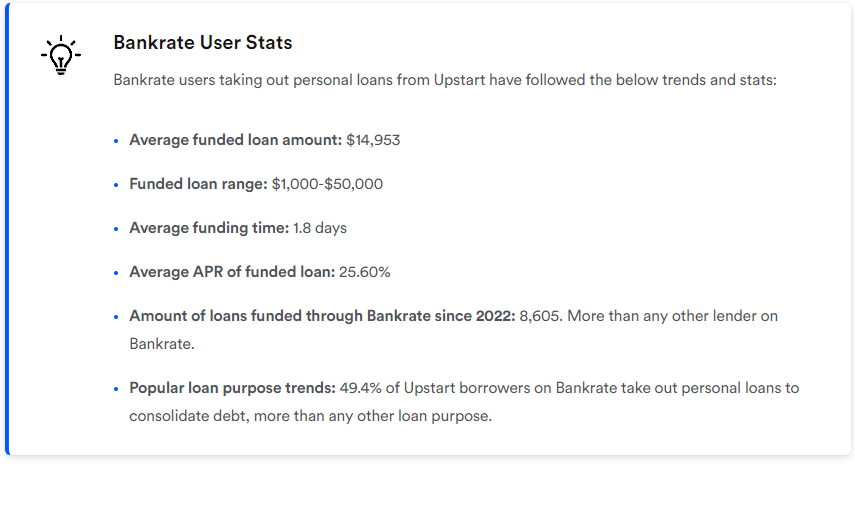

Upstart’s private loans characteristic versatile mortgage quantities of as much as $50,000. This makes its loans superb for quite a lot of functions, from dwelling enchancment initiatives to financing a big buy.

Loans from Upstart might also be a stable choice for good credit score debtors seeking to consolidate debt, due to its aggressive beginning charge. Moreover, the lender’s fast funding timeline and low minimal mortgage quantity of $1,000 might come in useful to cowl small emergency bills, equivalent to a medical invoice or a automobile restore.

That mentioned, California, Connecticut, Illinois, Washington and Washington, D.C. residents aren’t allowed to make use of Upstart’s loans to cowl education-related bills.

The place Upstart private loans stands out

- Choices for low credit score debtors: Upstart does not base eligibility solely on credit score rating, giving these with a very bad credit rating or no credit score in any respect the chance to get authorized.

- Low minimal APR: Upstart’s APR vary begins out at a aggressive 7.80 % — a lot decrease than the common private mortgage charge of about 12 %.

- Prequalification accessible: Debtors can view their charge earlier than submitting a proper software with out hurting their credit score.

- Fast funding: The corporate touts that mortgage funds could also be accessible as quickly as one enterprise day following approval.

The place Upstart private loans falls quick

- Origination payment: Upstart costs an origination payment as much as 12 % of the mortgage quantity, which is subtracted from the steadiness disbursed to you. That is increased than the trade common.

- Excessive most APR: Whereas debtors with a restricted credit score historical past might have higher luck getting authorized, additionally they have the chance of getting supplied a excessive most APR.

- Sure states have increased borrowing minimums: In Georgia, Hawaii and Massachusetts the minimal borrowing quantity is far increased than the $1,000 minimal.

- Restricted phrases: Upstart solely provides two reimbursement time period lengths to select from: 36 and 60 months. That is extremely restricted in comparison with rivals.

Upstart buyer expertise

Buyer help

Common help for private loans is on the market Monday by Sunday from 9 a.m. to eight p.m. ET. Fee help is on the market Monday by Friday from 9 a.m. to 9 p.m. ET and Saturday from 10 a.m. to 7 p.m. ET.

The customer support line is unavailable on New Years Day, Thanksgiving, Christmas Eve and Christmas Day.

Digital expertise

Debtors can apply for an Upstart mortgage totally on-line or over the telephone with the assistance of a consultant. Prequalification can also be accessible by the lender’s web site, so debtors can view their charge with out hurting their rating.

Upstart can also be one of many few lenders that has a whole listing of its set of necessities listed on its web site. Plus loans may be managed totally on-line by your browser. Upstart additionally provides a cellular app for account administration on iOS, however there is not at present one accessible for Android.

What individuals are saying about Upstart

Upstart boasts a formidable 4.9 out of 5 ranking on Trustpilot with over 45,600 buyer critiques as of March 19, 2024. Most debtors cite the velocity and ease of the applying course of together with nice buyer help as a part of their constructive expertise. A number of of those debtors have additionally taken multiple mortgage with the lender.

Destructive critiques primarily deal with getting quoted with excessive rates of interest, having to submit paperwork greater than as soon as and receiving a special provide from their unique quote.

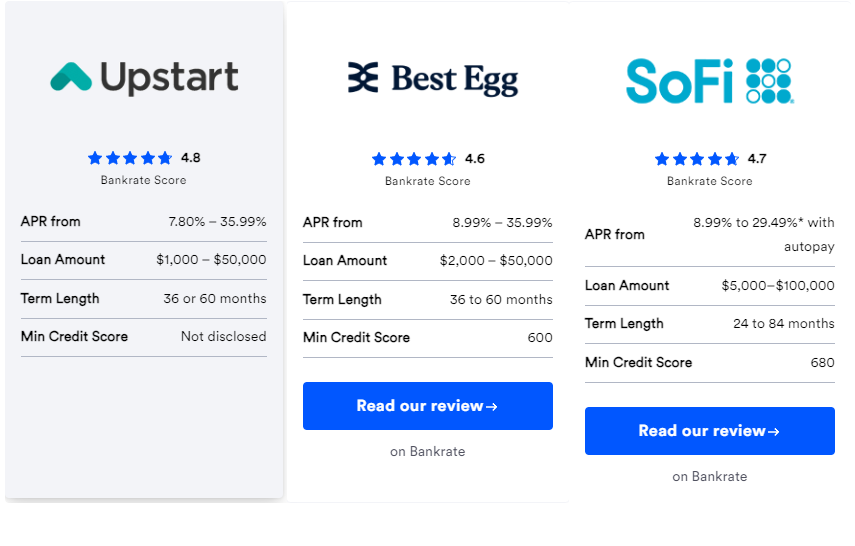

How this lender compares

Upstart vs. Greatest Egg

Upstart and Greatest Egg have almost an identical mortgage merchandise, with regards to reimbursement phrases, funding timelines, charges and quantities. That mentioned, Upstart’s beginning APR is barely decrease than Greatest Egg and so is its minimal mortgage quantity.

Debtors with a wonderful credit score rating ought to first take into account Upstart to probably rating probably the most aggressive charge. Upstart might also be higher for those who’re on the opposite finish of the spectrum. The lender was named as the general winner for very bad credit debtors within the 2024 Bankrate Awards as a consequence of its versatile eligibility standards.

Upstart vs. SoFi

SoFi and Upstart are polar opposites with regards to phrases and eligibility {qualifications}. Whereas Upstart does provide a decrease APR for probably the most creditworthy debtors, SoFi has the next borrowing most of $100,000 and reimbursement phrases of as much as 84 months. This makes the SoFi a greater choice for costly prices, like dwelling renovations and repairs.

SoFi additionally gained greatest on-line lender within the 2024 Bankrate Awards due to its best-in-class perks and advantages along with a speedy funding timeline. Nonetheless, if in case you have unhealthy or no credit score and don’t have a co-borrower, it might be simpler to get a mortgage with Upstart.

Do you qualify for an Upstart private mortgage?

Like different lenders, Upstart requires debtors to be a minimum of 18 outdated, have a legitimate bodily handle and Social Safety quantity, along with assembly the next standards:

- A minimal annual revenue of $12,000.

- Have a full-time job, a job provide beginning inside six months or one other supply of normal revenue.

- Have a verifiable private checking account with a routing quantity at a US monetary establishment.

- Not be a resident of Iowa or West Virginia.

The way to apply for a private mortgage with Upstart

Debtors can apply for an Upstart mortgage on-line or over the telephone. To use on-line you may simply must comply with three steps:

- Get a quote: Decide how a lot it’s worthwhile to borrow and prequalify on-line. Be sure you account for any origination charges when operating numbers.

- Add info and finalize your software: When you’re happy with the charges and phrases, fill out a proper software. Chances are you’ll want to offer pay stubs and employment info as a part of the method.

- Overview the mortgage particulars: When you obtain your approval letter, make sure that all the pieces is so as, together with your new fee quantity and due date. If something appears amiss, contact Upstart’s buyer help line. Upstart disburses the funds as quickly as the subsequent enterprise day following approval.

Charges and penalties

One of many greatest charges Upstart costs is the origination payment — which may be as much as 12 % of the mortgage quantity. The origination payment is deducted out of your mortgage funds earlier than you obtain them, so it’s vital to borrow sufficient to make sure that you get the amount of cash you want.

Upstart costs a late payment of 5 % of the past-due quantity or $15, whichever is larger, for those who’re greater than 10 calendar days previous your due date. There’s additionally an ACH return or verify refund payment of $15. Lastly, for those who request to change from getting information electronically to getting paper copies, there’s a $10 payment.

Upstart doesn’t cost a prepayment penalty, so that you don’t have to fret about incurring an additional payment for paying the mortgage off early.

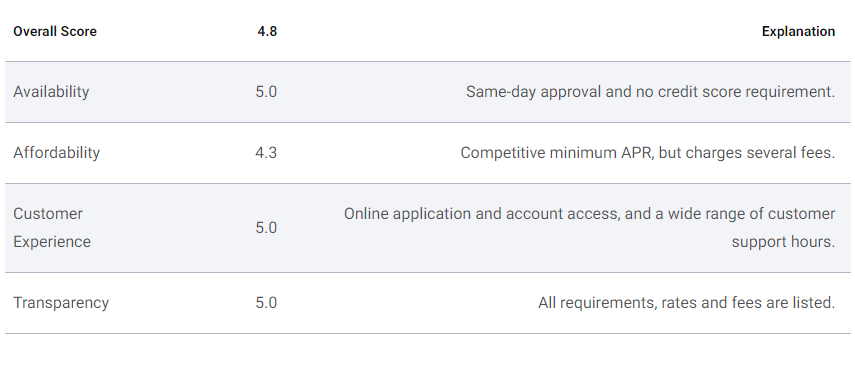

How Bankrate charges Upstart

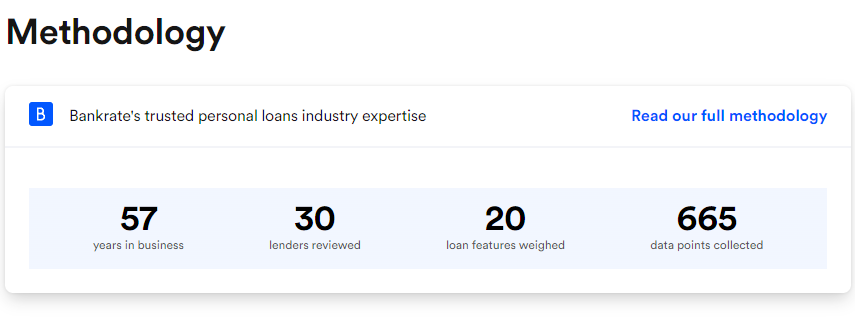

Bankrate considers 20 elements when reviewing lenders. Credit score necessities, APR ranges, charges, mortgage quantities and adaptability are all taken under consideration in order that scores are consultant of how aggressive lenders are for a variety of credit score profiles and budgets. The Bankrate Rating for private loans consists of 4 classes:

- Availability: What the minimal mortgage quantities are, its eligibility necessities and mortgage turnaround are thought-about on this class.

- Affordability: The rates of interest, penalties and charges are measured on this part of the rating. Decrease charges and charges and fewer potential penalties lead to the next rating.

- Buyer expertise: This class covers customer support hours, if on-line purposes can be found, on-line account entry and cellular apps.

- Transparency: This class is measured by how accessible credit score necessities, charges and charges are on the lender’s web page. We additionally thought-about whether or not prequalification was accessible, as all these elements are key for customers to make an knowledgeable choice.

Editorial disclosure: All critiques are ready by lifelayered.com employees. Opinions expressed therein are solely these of the reviewer and haven’t been reviewed or authorized by any advertiser. The knowledge, together with charges and charges, offered within the overview is correct as of the date of the overview. Verify the information on the prime of this web page and the lender’s web site for probably the most present info.